ULIP Insurance Plan

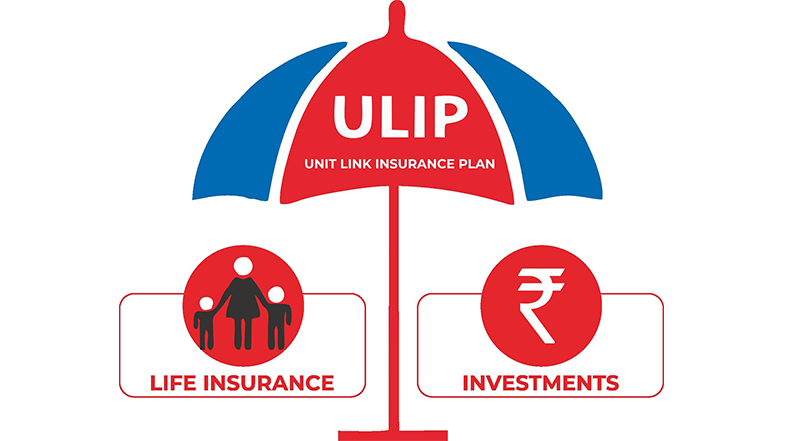

ULIP, short for Unit Linked Insurance Plan, is a type of life insurance policy that provides both insurance coverage and investment opportunities. ULIPs allow the policyholder to invest a portion of their premium in different funds of their choice, such as equity, debt, or balanced funds, based on their risk appetite and financial goals.

The premiums paid by the policyholder are divided into two parts – one portion is used to provide insurance coverage, while the other is invested in various funds chosen by the policyholder. The returns on the investment portion of the premium depend on the performance of the underlying funds. If the funds perform well, the policyholder may receive higher returns, but if the funds perform poorly, the returns may be lower.

In addition to providing investment opportunities, ULIPs also offer various benefits such as tax savings, flexibility to switch between funds, and the option to add riders for additional coverage.

It is important to note that ULIPs come with various charges such as premium allocation charges, fund management charges, mortality charges, and surrender charges, which can affect the returns on the investment portion of the premium. Therefore, it is essential to understand the terms and conditions of the policy and its associated charges before investing in a ULIP.

ULIPs have a lock-in period of five years. So, you cannot liquidate your investments or withdraw the fund value before the completion of five years from the date of policy issue. Prior to 2010, this lock-in period in ULIPs was set at three years.